Stephen Dick, Jr. and Stuart Cadwell, the owners of “Nite Moves,” a strip-club up in Latham, New York, challenged a New York Division of Taxation determination, which held that the club owed some $300,000 in unpaid taxes for--among other things--revenue collected from private (lap) dances.

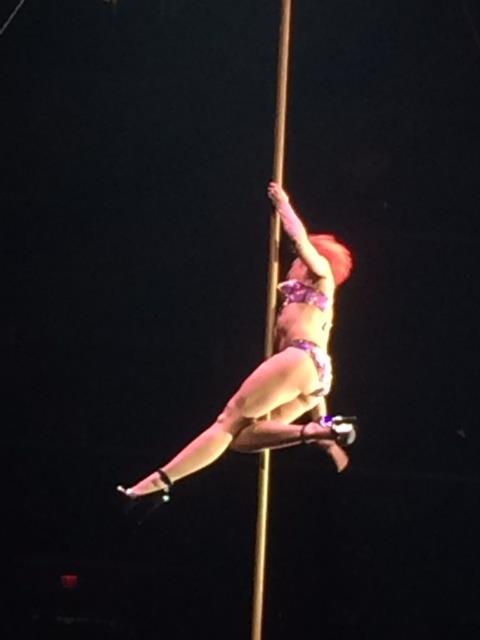

While the New York State Division of Tax Appeals was of the view that pole-dancing revenue was tax exempt (because those "performances" are a form of artistic expression), private couch-dancing dollars were taxable because that work involved physical contact (“body rubbing”), supposedly lacked “choreography,” and didn’t occur on a stage.

Were they stripped of their cash?

To view a copy of the Division of Tax Appeals’ decision, please use this link: 677 New Loudon Corp. dba Nite Moves, Dick, Cadwell