COMPTROLLER STRINGER REVEALS ASSESSED VALUE OF FLOOD ZONE PROPERTIES MORE THAN DOUBLED UNDER NEW FEMA INSURANCE MAPS

Calls for FEMA to Tie Public Investment in Resiliency to Reduced Insurance Premiums

A new analysis by New York City Comptroller Scott M. Stringer revealed that the assessed value of properties that lie within newly proposed 100-year floodplain maps is $129 billion, more than double the value under previous flood plain maps issued by the Federal Emergency Management Agency (FEMA). Stringer made a series of recommendations to better protect homeowners from the effects of flooding on their homes and their insurance premiums.“This new data demonstrates clearly the need for New York to invest in resiliency projects to protect those in the flood zone,” Comptroller Stringer said. “These investments should benefit not only the safety of those in high-risk flood zones, but also potentially lower their insurance premiums. We need FEMA to be responsive to regional investments in the physical environment to ensure that when resiliency work is completed by cities or states, those efforts are reflected in rates area homeowners will pay.”

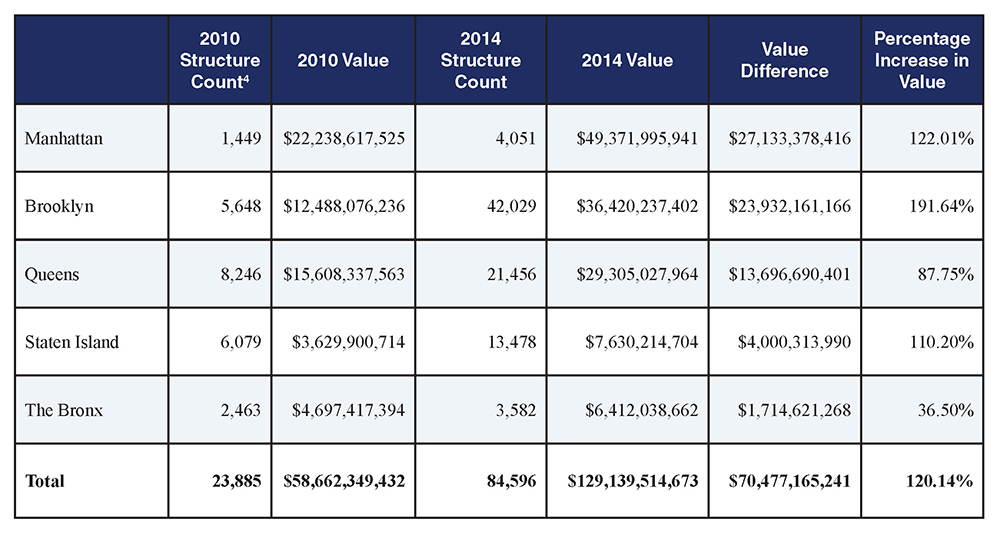

Comptroller Stringer’s analysis, “On the Frontlines”, showed that under the 2010 flood plain maps, the value of buildings inside the 100-year flood zones was approximately $58.6 billion. Under the newly proposed 100-year flood zones, the value of buildings more than doubles to $129.1 billion, with three and a half times as many structures in high-risk zones and a nearly 200 percent increase in value in Brooklyn.

To better protect the City’s physical and fiscal well-being against future weather events and the mounting risk posed by climate change, Comptroller Stringer recommends:

- · Accelerating the pace of investment in resiliency projects and shoreline improvement, which will allow the City to transform its physical footprint to better withstand the threat posed by future storms.

With the immense value of properties along the City’s coastal areas, it is necessary to make investments to protect homes, businesses and neighborhoods from the future effects of climate change. Investment in resiliency has a multiplier effect: for every dollar spent on resiliency and disaster mitigation there are four dollars in potential savings. While New York City has spent billions on delivering a resilient recovery for affected citizens, the City has been slow to dispense dedicated HUD money for coastal protection and building mitigation measures. In this category of CDBG funding, only $57,000 of an allotted $284 million for dedicated resiliency projects has been spent as of last quarter.

- · Calling on FEMA to expedite review of risks and premiums after the completion of large-scale resiliency work. Public investment should reduce premiums.

Flood insurance can be purchased through the private market or the National Flood Insurance Program (NFIP), which is administered by FEMA but often sold and serviced by private insurance companies. The expansion of the 100-year flood zones, along with recent legislative changes, means that mandatory insurance rates will potentially spike for thousands of New Yorkers. According to the Center for New York City Neighborhoods, rates may rise as much as 18 percent per year for similar levels of home coverage, an enormous hardship for thousands of New Yorkers in affected areas, many of whom earn less than 60 percent of the New York City Area Median Income.

While some property owners have taken steps, such as physically raising their properties, to help reduce their exposure to flooding, large-scale resiliency projects should also have the potential to lower insurance rates. However, FEMA is not obligated to update its premiums in real-time, meaning that large-scale changes may not be reflected in FEMA maps and insurance rates for decades. The Comptroller urged FEMA should be required to regularly review the efficiency of implemented resiliency measures on a regional basis.

- · Utilizing scientific research on flood risk and climate change to better inform municipal decisions and the City’s capital plan.

Because the City usually self-insures against flooding or other disaster related damages, the City will be obligated to carry hundreds of thousands of dollars in hazard insurance on buildings that received federal assistance following Superstorm Sandy. The Comptroller recommended that the City mitigate the exposure of its assets to climate change by requiring agencies to account for climate risk in the planning and siting of future capital projects.

“The impact of Superstorm Sandy is still felt acutely across our City’s 578 miles of shoreline. The accelerating effects of climate change mean that planning, preparation and investment are critical to our City’s physical and financial well being. Before the next storm arrives, the City must make every effort to safeguard property, as well as the lives and well-being of our citizens, against the increased reach of floodwaters,” Stringer said.

To read the full analysis, please click here.