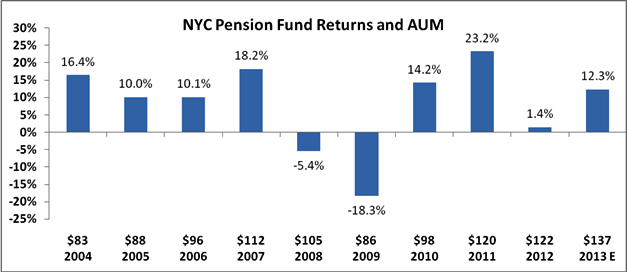

PRELIMINARY DATA: NYC PENSION FUNDS RETURNED 12.3 PERCENT IN FISCAL YEAR 2013

Fourth Consecutive Year of Positive Returns

City Comptroller John C. Liu today announced that preliminary unaudited numbers indicate the New York City Pension Funds recorded investment returns of 12.3 percent for Fiscal Year 2013, which ended June 30, bringing the total fund value to approximately $137 billion — the highest ever for a fiscal year end. The 12.3 percent return exceeded by approximately 1 percent the combined and weighted average of the Funds' various asset class benchmarks.

Fiscal Year 2013 marks the fourth consecutive year of recorded gains by the Pension Funds, and follows investment returns of 14.2 percent in FY 2010, 23.2 percent in FY 2011, and 1.4 percent in FY 2012. Under Comptroller Liu, the New York City Pension Funds have an estimated annualized rate of return of 9.5 percent. The Funds have estimated annualized return rates of 7.5 percent over the past 10 years, 7.8 percent over the past 20 years, and 9.3 percent over the past 30 years. The Funds currently have an actuarial Assumed Rate of return of 7.0 percent.

NYC Pension Funds 10-Year Rate of Return Trend Chart (FY ending June 30)

For the nine months period ending March 31, 2013 — the most recent data available — the New York City Pension Funds were in the first quartile in the Trust Universe Comparison Service (TUCS) comparative performance rankings. TUCS metrics for the end of the Fiscal Year will not be available until fall.

"We have enjoyed several years of strong returns thanks to the Trustees of the Pension Boards and our hardworking Bureau of Asset Management staff," Comptroller Liu said. "CIO Larry Schloss and our investment team took advantage of rebounding markets and minimized the rollercoaster volatility that has historically hurt investors. Sustained performance like this not only ensures City workers' retirement payments, it also saves taxpayers money."

"The investment environment has been buoyed over the past 12 months by the Federal Reserve's sustained and coordinated extraordinarily accommodating monetary policy, which has resulted in continued, though tepid, economic growth coming out of the recent recession," said Deputy Comptroller and Chief Investment Officer Larry Schloss. "New York City's strong pension performance was primarily due to the rising U.S. equity market, our over-policy allocations and strong manager performance in U.S. equities and high yield debt, and our under allocation to U.S. government and TIPS bonds."

Audited numbers for FY 2013, including final performance numbers for real estate, private equity and some asset classes that currently are measured as of March 31, will be available later in the fall.

_______________________

New York City Comptroller John C. Liu serves as the investment advisor to, custodian, and trustee of the New York City Pension Funds. The New York City Pension Funds are composed of the New York City Employees' Retirement System, Teachers' Retirement System, New York City Police Pension Fund, New York City Fire Department Pension Fund, and the Board of Education Retirement System.

The Funds have an estimated $137 billion in assets under management as of June 30.

In addition to Comptroller Liu, the New York City Pension Funds trustees are:

Teachers' Retirement System: Deputy Chancellor Kathleen Grimm, New York City Department of Education; and Sandra March, Melvyn Aaronson (Chair) and Mona Romain, all of the United Federation of Teachers; Janice Emery, Mayor's Representative.

New York City Employees' Retirement System: New York City Public Advocate Bill de Blasio; Borough Presidents: Scott Stringer (Manhattan), Helen Marshall (Queens), Marty Markowitz (Brooklyn), James Molinaro (Staten Island), and Ruben Diaz, Jr. (Bronx); Lillian Roberts, Executive Director, District Council 37, AFSCME; John Samuelsen, President Transport Workers Union Local 100; Gregory Floyd, President, International Brotherhood of Teamsters, Local 237; Janice Emery, Mayor's Representative (Chair).

New York City Police Pension Fund: New York City Police Commissioner Raymond Kelly (Chair); Patrick Lynch, Patrolmen's Benevolent Association; Michael Palladino, Detectives Endowment Association; Edward D. Mullins, Sergeants Benevolent Association; Louis Turco, Lieutenants Benevolent Association; Roy T. Richter, Captains Endowment Association; New York City Finance Commissioner David Frankel; and Janice Emery, Mayor's Representative.

New York City Fire Department Pension Fund: New York City Fire Commissioner Salvatore Cassano (Chair); New York City Finance Commissioner David Frankel; Stephen Cassidy, President, James Slevin, Vice President, Robert Straub, Treasurer, and John Kelly, Brooklyn Representative and Chair, Uniformed Firefighters Association of Greater New York; Patrick Reynolds, Captains' Rep.; James Lemonda, Chiefs' Rep., and James J. McGowan, Lieutenants' Rep., Uniformed Fire Officers Association; and, Sean O'Connor, Marine Engineers Association; Janice Emery, Mayor's Representative.

Board of Education Retirement System: Schools Chancellor Dennis Walcott; Mayoral: Joseph Lewis, Jeanette Moy, Ian Shapiro, Tino Hernandez, Judy Bergtraum, Allison Rogovin, and Milton Williams; Patrick Sullivan (Manhattan BP), Kelvin Diamond (Brooklyn BP), Dmytro Fedkowskyj (Queens BP), Robert Powell (Bronx BP) and Diane Peruggia (Staten Island BP); and employee members Joseph D'Amico of the IUOE Local 891 and Milagros Rodriguez of District Council 37, Local 372.