PRELIMINARY DATA SHOW NYC PENSION FUNDS RETURNED 1.7 PERCENT IN FISCAL YEAR 2012

PRELIMINARY DATA SHOW NYC PENSION FUNDS RETURNED 1.7 PERCENT IN FISCAL YEAR 2012

-3rd consecutive year of positive returns protect gains made in FY 10 and FY 11 -

***********************************

City Comptroller John C. Liu announced that preliminary unaudited numbers indicate the New York City Pension Funds recorded investment returns of 1.7 percent for Fiscal Year 2012, which ended June 30, bringing the total fund value to approximately $122 billion - the highest ever recorded to end a fiscal year.

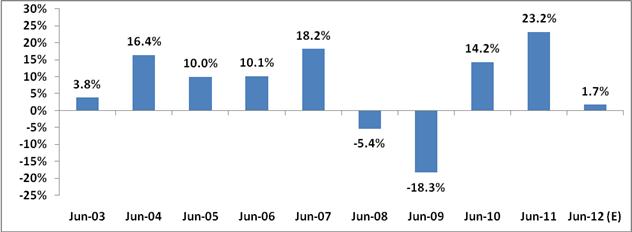

Fiscal Year 2012 marks the third consecutive year of recorded gains by the Pension Funds, and follows investment returns of 14 percent in Fiscal Year 2010 and 23 percent in Fiscal Year 2011. Over the past 10 years, the New York City Pension Funds have an estimated average rate of return of 6.7% with a 20-year estimated return of 8.0%. The Funds currently have an Actuarial Assumed Rate of return of 8.0%, which is expected to be reduced to 7.0% in the fall.

NYC Pension Funds 10-Year Rate of Return Trend Chart (FY ending June 30)

As of March 31, 2012 (nine months of FY 2012) - the most recent data available - the New York City Pension Funds were in the second quartile in the Trust Universe Comparison Service (TUCS) ratings. TUCS metrics for the end of the Fiscal Year will not be available until fall.

"The past 12 months have been an extremely challenging investment period with bouts of high volatility caused by the European elections, the sovereign-debt and banking crises, tepid US economic growth, high unemployment and a slowing global economy," said Deputy Comptroller and Chief Investment Officer Larry Schloss. "Despite the Federal Reserve's actions to maintain and reduce US interest rates, Europe's difficulties in dealing with its fiscal, banking-sector, and sovereign-debt issues have subjugated long-term investing to short-term market moves. We remain focused, however, on implementing our long-term asset allocations, which we revised during this fiscal year."

"Credit is due to the Trustees of the Pension Boards as well the hardworking staff in the Bureau of Asset Management for devising a strategy that secured gains during a tough fiscal year," Comptroller Liu said. "Many factors outside our control played a role in the Funds' performance, but under the guidance of Larry Schloss we were able to navigate the markets in a way that better manages costs to City taxpayers."

Together with the Trustees of the five Pension Boards (The New York City Teachers' Retirement System, The New York City Employees' Retirement System, The New York City Police Pension Fund, The New York City Fire Department Pension Fund, and the Board of Education Retirement System), the Comptroller's Bureau of Asset Management (BAM) has made a number of changes during the past 30 months in order to enhance the management of the $122 billion Funds.

Earlier this year, the Funds finalized their first asset allocation in more than five years, yielding a more balanced portfolio better positioned for today's markets. The realization of the new asset allocation is ongoing and will continue throughout the current Fiscal Year and beyond.

Working with the Boards of Trustees, the Comptroller's office has reduced the time it takes to hire new managers by an average of 10 months, allowing the Funds to be more nimble and capitalize on market trends.

In addition, the Bureau of Asset Management has expanded the Minority and Women Owned Business Enterprise and Emerging Manager programs by $400 million, to $6.4 billion. As part of the expansion, BAM has allocated an additional $250 million for new private-equity emerging managers.

Earlier this year, BAM worked closely with the Pension Boards to begin live webcasts of investment meetings and publish meeting agendas and performance documents online at: http://www.comptroller.nyc.gov/mymoneynyc/pensionnyc/

Audited numbers for FY 2012 including performance by asset class will be available later in the summer.