Message from Liz . . .

Once again our leaders in Washington are fighting over cuts to the deficit, while our economy teeters on the brink of a "double dip" recession. At both the federal and state level the focus is on cutting programs rather than increasing revenues. But what many of these leaders have chosen to ignore is the fact that this strategy will have radical macro and micro economic, and political, consequences for decades to come.

Message from Liz . . .

Once again our leaders in Washington are fighting over cuts to the deficit, while our economy teeters on the brink of a "double dip" recession. At both the federal and state level the focus is on cutting programs rather than increasing revenues. But what many of these leaders have chosen to ignore is the fact that this strategy will have radical macro and micro economic, and political, consequences for decades to come.

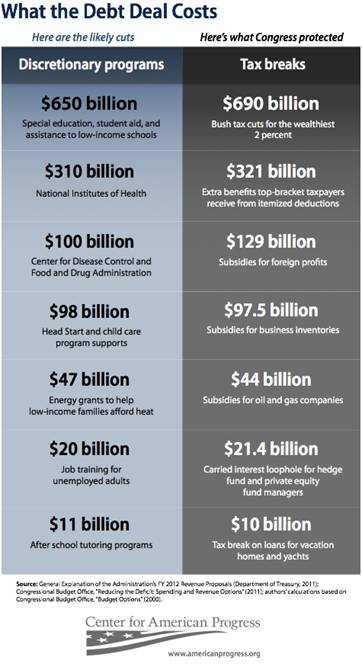

Take a look at the chart to the left. Please understand how dire these federal cuts will be on everyone! You might not think you will ever need to collect unemployment... but stop and consider how many people you know who've lost their job in the last three years (and read my policy spotlight at end of this community bulletin). Maybe you don't think cutting government education aid to poor children will impact you personally. But do you think that our country will somehow gain an economic competitive advantage with even lower educational outcomes? And what about destroying funding for public health (CDC) and health research (NIH)? Are we really trying to say we've solved all those issues? Please think about this: instead of creating a fair, progressive tax system in this country, we are trading vital programs away.

Take a look at the chart to the left. Please understand how dire these federal cuts will be on everyone! You might not think you will ever need to collect unemployment... but stop and consider how many people you know who've lost their job in the last three years (and read my policy spotlight at end of this community bulletin). Maybe you don't think cutting government education aid to poor children will impact you personally. But do you think that our country will somehow gain an economic competitive advantage with even lower educational outcomes? And what about destroying funding for public health (CDC) and health research (NIH)? Are we really trying to say we've solved all those issues? Please think about this: instead of creating a fair, progressive tax system in this country, we are trading vital programs away.

Did you read Warren Buffett's OpEd in the August 14th New York Times -- Stop Coddling the Super-Rich?

"OUR leaders have asked for "shared sacrifice." But when they did the asking, they spared me. I checked with my mega-rich friends to learn what pain they were expecting. They, too, were left untouched. While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks. Some of us are investment managers who earn billions from our daily labors but are allowed to classify our income as "carried interest," thereby getting a bargain 15 percent tax rate. Others own stock index futures for 10 minutes and have 60 percent of their gain taxed at 15 percent, as if they'd been long-term investors..."

He's talking about a decent number of my constituents. Although I am more likely to be called upon for help from frail elderly constituents who can't afford both their rent and their prescription medications; or parents wondering how their children can actually be "wait listed" for a seat in their over-crowded public school; or people who are middle aged but have been unemployed for so long that they are scared that there is no place for them in the "new economy"; or 20 somethings who tell me they think they'll be working into their 70's because they don't expect a Social Security/Medicare system to be in place for them.

So, as just one of your elected officials in a community of Manhattan that includes a disproportionate number of well off, wealthy and super rich --- if you agree with Warren and me, could you please make some noise. Mr. Buffet is from Nebraska - a fine state. But elected leaders in New York and Washington need to hear you demand a change in direction so we can get this country back on track. Tell the President, the Governor, the Mayor and every member of Congress. Tell us! We need to hear your ideas and your support in order to take unpopular positions. I am told I am insane to support higher taxes for the rich --- I represent the wealthiest Senate District in the State. But the true insanity comes from those who are pushing to strip our country of the type of government that has made it great. We cannot allow this to happen, we must push back. I teach high school students in my annual youth civics program that voting is not enough. Holding on to our frail participatory democracy requires strong and immediate action. When Congress returns to Washington after its August recess, it will enter the next phase of consideration under the recently passed debt ceiling deal. The Joint Select Committee on Deficit Reduction (also known as the "Super Committee") will hold its first meeting and begin to develop plans to cut the deficit by an additional $1.5 trillion. It is critical that this next round of cuts does not impose greater damage on our nation's safety net.And yes, there is a way we can prevent these cuts and protect these services. Increasing tax revenues from large corporations and those most able to pay must be on the table.