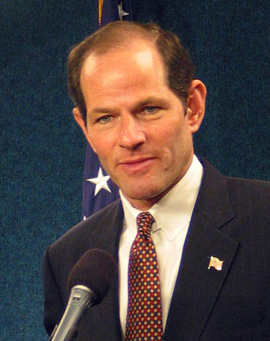

In Matter of People of State of New York v. Applied Card System, Inc. , former Attorney General Eliot Spitzer, pictured right, filed suit on behalf of New Yorkers who had been solicited for credit cards by Cross Country Bank (CCB).

In Matter of People of State of New York v. Applied Card System, Inc. , former Attorney General Eliot Spitzer, pictured right, filed suit on behalf of New Yorkers who had been solicited for credit cards by Cross Country Bank (CCB).

CCB targeted "sub-prime credit market" consumers -- those who normally wouldn't "qualify for credit under traditional underwriting guidelines and principles."

The then Attorney General alleged that, in violation of New York law, CCB had "misrepresented the credit limits that sub-prime consumers could obtain and that it failed to disclose the effect that its origination and annual fees would have on the amount of initially available credit."

CCB informed customers they would be automatically pre-approved for a credit limit "up to" $2,500, when that number was often as low as $350. CCB supposedly told its customers there would be no late fees or collection calls, but later "clarified that such fees would be imposed and such calls made in certain instances."

There was also deceptive conduct relating to coverage for "death, disability, unemployment, or family leave," in a benefits program, and a "re-aging process" for "severely delinquent cardholders to bring their accounts current through a series of payments." (CCB failed to explain the late charges that would still accrue during that process.)

CCB countered it complied with the Federal Truth-in-Lending Act (TILA) and, according to the Fair Credit and Charge Card Disclosure Act of 1988 (FCCCDA), TILA overrode "any provision of the law of any State relating to the disclosure of information in any credit or charge card application," and preempted New York's Executive Law and Consumer Protection Act.

The Albany County Supreme Court found the Attorney General's claims weren't overridden by TILA and "permanently enjoined [CCB] from engaging in future fraud, deception, and false advertising." On appeal, the Appellate Division, Third Department, affirmed.

When the case reached the New York State Court of Appeals, that court found FCCCDA and TILA only overrode "those state laws that relate to 'disclosure of information,'" including annual percentage rates, annual fees, minimum finances and transaction charges, grace periods, late fees, over-the-limit fees, and the like. New York laws, on the other hand, addressed a credit card company's duty to "refrain from fraud, deception, and false advertising when communicating with New York customers."

Since the Attorney General's claims didn't "relate to the disclosure of credit information" but sought to address an "affirmative deception," our state's unfair trade practices law was unaffected by the federal statutes.

A lone dissenter, Judge Read, thought FCCCDA and TILA "set out comprehensive requirements and established a singular federal mechanism to add to or modify these requirements." Therefore, Read believed New York was prohibited from imposing any of its consumer protections laws on a nationwide industry.

You gotta give the court credit for that.

For a copy of the Court of Appeals' decision, please use this link: Matter of People of State of New York v. Applied Card System, Inc.