According to information publicly disseminated by Douglas Elliman’s representatives, condo and co-op sales experienced a dramatic decrease, and residential rental vacancies are at an all-time low. Inventory available for sale is rising due to escalating interest rates and inflation, resulting in would-be buyers continuing to rent. The consequential stress on the rental market, paired with an inventory shortage leads to bidding wars over limited rental housing supply. (Rising interest rates will make home purchases nearly double in cost compared to the same time last year.)

Elliman’s mid-June update revealed that the number of signed contracts in Manhattan are down 34% from June 2021 to June 2022. During that same period, sales volume decreased 21%, and the median sales price is up 13.6%. In Brooklyn, the number of signed contracts remained the same, yet the sales volume was down 12%, while the median sales price increased 3%.

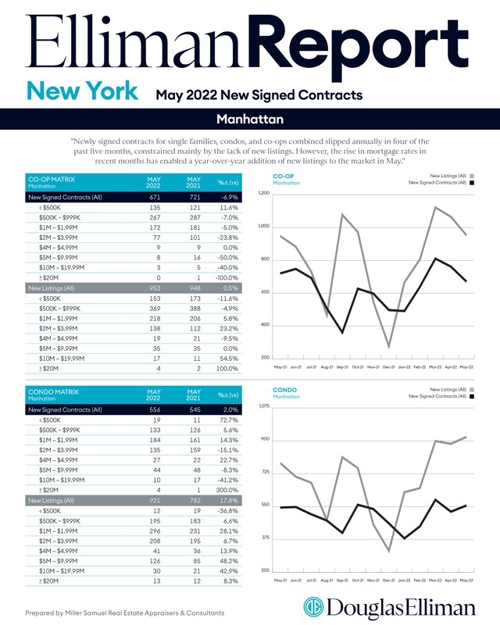

As for co-ops, between May 2021 and May 2022, the average sales price decreased from $1,606,454 to $1,427,767. The median sales price decreased from $987,500 to $852,500. Discounts from the original asking price decreased from 9% to 4% and discounts from the last asking price decreased from 4.2% to 2%. Transactions over $1,000,000 decreased from 48% to 43%, and transactions under $1,000,000 increased from 52% to 57%. The Initial Index offer decreased from 5.66% to 3.67%. The median number of days on the market from the last ask price increased from 58 days to 68 days. As of May 2022, 68% of co-op sales are financed, of which 73% are contingent on financing. International buyers make up 4% of the co-op sales and 35% of the co-ops sold at ask and above the asking price.

As for condos, between May 2021 and May 2022, the average sales price decreased from $3,212,081 to $3,171,597. The median sales price increased from $2,027,500 to $2,110,000. Discounts from the original asking price decreased from 7% to 5% and discounts from the last asking price decreased from 4.8% to 2.5%. Transactions over $1,000,000 remained the same at 82%, and transactions under $1,000,000 remained the same at 18%. The Initial Index offer decreased from 6.48% to 3.52%. The median number of days on the market from the last ask price decreased from 57 days to 55 days. As of May 2022, 51% of condo sales are financed, of which 65% are contingent on financing. International buyers make up 13% of the condo sales, 33% of the co-ops sold at ask and above the asking price, and 13.4% of condo sales are new developments. Finally, the number of active listings on the market for co-ops and condos increased by 4.6%.