Comptroller Stringer, NYC Pension Funds Launch National Boardroom Accountability Project Campaign — Version 2.0

Groundbreaking initiative escalates push for corporate board diversity, independence, and climate expertise

After launching the trailblazing “Boardroom Accountability Project” in 2014 to give investors a real voice in who sits on corporate boards, New York City Comptroller Scott M. Stringer and the New York City Pension Funds launched the “Boardroom Accountability Project 2.0.” The next phase of the campaign will ratchet up the pressure on some of the biggest companies in the world to make their boards more diverse, independent, and climate-competent, so that they are in a position to deliver better long-term returns for investors.

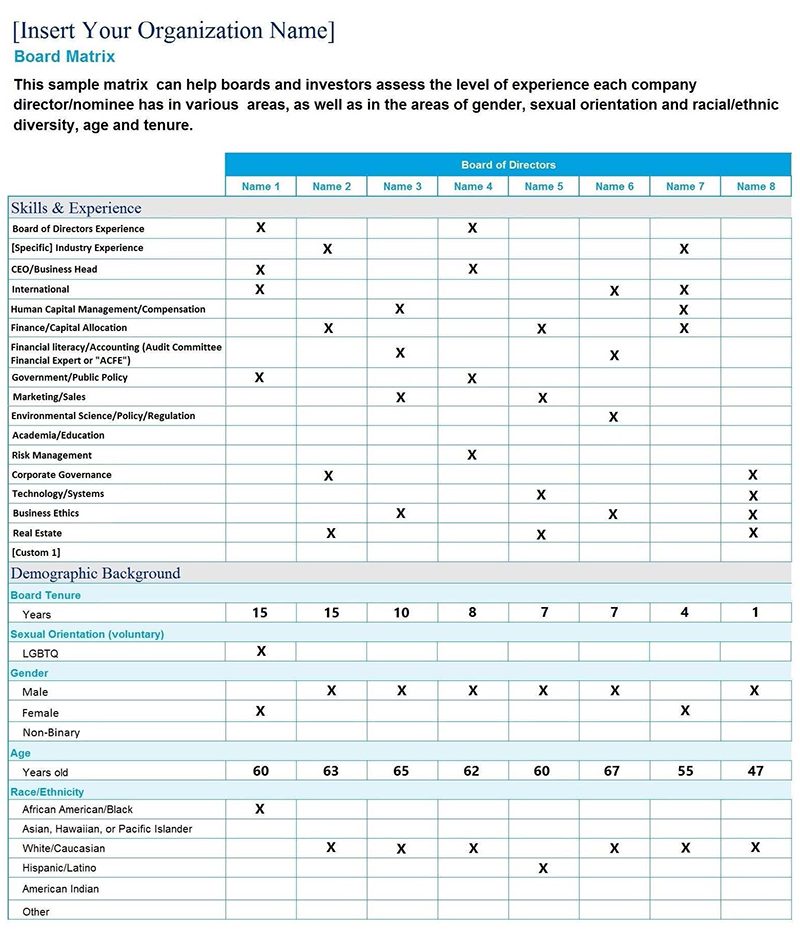

As part of the campaign’s launch, Comptroller Stringer and the NYC Pension Funds are calling on the boards of 151 U.S. companies to disclose the race and gender of their directors, along with board members’ skills, in a standardized “matrix” format – and to enter into a dialogue regarding their board’s “refreshment” process. At present, directors’ race and gender is rarely — if ever — released publicly. If disclosed, it would increase transparency and accountability across the market — and push more boards to be diverse and independent.

The campaign for more diversity and accountability in boardrooms comes in response to a history of costly corporate scandals. Over the past 15 years, weak boards — often rife with conflicts of interest, and largely lacking diversity — have failed to catch accounting fraud at Enron and WorldCom, to rein in the excessive risk taking that led to the financial crisis, and to set the proper tone at the top for ethical conduct at Wells Fargo. Each of these crises destroyed billions in shareowner value.

Today’s persistent lack of diversity on corporate boards is largely due to a nomination and “election” process that is effectively controlled by the existing board — and as a result, more akin to a coronation. At S&P 500 companies, for example, just 21% of board members are women, 5% are African American, 3% are Asian, and 2% are Hispanic. This disparity exists despite studies that show diverse groups make better business decisions.

This lack of board quality and diversity can be traced to boards’ failure to cast a wide net when looking for new members. According to PwC’s 2016 Annual Corporate Directors Survey, 87% of directors said they rely on board member recommendations to recruit new directors, while only 18% said they consider investor recommendations.

As part of today’s launch, Comptroller Stringer sent letters to the boards of 151 companies – 92% of which have “proxy access” and 80% of which are in the S&P 500 – calling on them to publicly disclose the skills, race and gender of board members and to discuss their process for adding and replacing board members, known as the “board refreshment” process, with the Comptroller’s Office.

“When we launched our Boardroom Accountability Project back in 2014, we set out to give investors a true voice in who sits on corporate boards. Now that we have that power, it’s time to raise our voice and demand change at some of the biggest companies in the world,” New York City Comptroller Scott M. Stringer said. “Diversity isn’t a box to be checked – it’s a strategy for economic success. Today, we’re doubling down and demanding companies embrace accountability and transparency.”

The initial phase of the Boardroom Accountability Project fought company-by-company to make “proxy access” — the right of large, long-term shareowners to nominate corporate board candidates on a company’s ballot — a market standard. When the project began, just six U.S. companies embraced proxy access. Today, more than 425 do, including over 60% of the S&P 500. Further, over the past three years, at least 27 of the 51 companies that the Comptroller targeted for proxy access due to inadequate board diversity have added at least 43 directors who are women, non-white, or both, and the largest oil and gas company in the world added a climate scientist to its board.

Proxy access is a powerful tool and the mere specter of a proxy access candidate is expected to make boards more responsive to their shareowners. But to effectively exercise their newly won voice, shareowners need to know the race and gender of a company’s directors, information that is — by-and-large — unreported today. In addition, shareowners need to see how each director’s skills and experience fits into the company’s overall strategy, where there are gaps, and understand how boards are refreshed.

This information — which would be released every year as a “board matrix” — would give a birds-eye view of the board as a whole, while spelling out the skills each director brings to the table, and highlighting their gender and race. This type of standardized disclosure would boost accountability and allow shareowners like the New York City Pension Funds, to identify boards that are ill-suited to protect their investments due to a lack of diversity or relevant expertise. The requested disclosures will also allow shareowners to engage companies to recommend qualified, diverse, and independent candidates.

Previously in 2015, the Comptroller’s Office and New York City Pension

Funds — along with eight other major U.S. pension systems —

submitted a rulemaking petition to the SEC that would make this type of

disclosure mandatory market-wide. While the SEC has yet to take action

on the petition, it is unlikely the current administration in Washington

would support this reform — making company-by-company engagement

like Comptroller Stringer’s all the more important.

An example board matrix — click to expand

In addition, Comptroller Stringer and the New York City Pension Funds are pressing companies to commit to working with them and other large, long-term shareowners to identify suitable independent candidates — including ones that bring diverse perspectives and other skills, such as climate expertise, to the boardroom.

By agreeing to disclose this information and regularly engage with shareowners on the composition and refreshment of their boards, companies will increase transparency, expand diversity, and strengthen board oversight – helping to create sustainable value for investors.

The 151 companies include 139 that enacted proxy access after receiving a proposal from the New York City Pension Funds, and 12 at which the pension funds’ proposal received majority shareowner support in 2017, but have yet to enact the reform.

For a full list of the companies that received letters, click here.

For an example of the letter that went to companies with proxy access, click here.

For an example of the letter that went to companies that have yet to enact proxy access, click here.

For an example of a board matrix, click here.

Comptroller Stringer serves as the investment advisor to, and custodian and a trustee of, the New York City Pension Funds. The New York City Pension Funds are composed of the New York City Employees’ Retirement System, Teachers’ Retirement System, New York City Police Pension Fund, New York City Fire Pension Fund and the Board of Education Retirement System.

In addition to Comptroller Stringer, the New York City Pension Funds’ Trustees are:

New York City Employees’ Retirement System: Mayor Bill de Blasio’s Representative, John Adler (Chair); New York City Public Advocate Letitia James; Borough Presidents: Gale Brewer (Manhattan), Melinda Katz (Queens), Eric Adams (Brooklyn), James Oddo (Staten Island), and Ruben Diaz, Jr. (Bronx); Henry Garrido , Executive Director, District Council 37, AFSCME; John Samuelsen, President Transport Workers Union Local 100; Gregory Floyd, President, International Brotherhood of Teamsters, Local 237.

Teachers’ Retirement System: Mayor Bill de Blasio’s Appointee, John Adler (Chair); Raymond Orlando, representing the Chairperson of the Panel for Educational Policy and Debra Penny, Thomas Brown and David Kazansky, all of the United Federation of Teachers.

New York City Police Pension Fund: Mayor Bill de Blasio’s Representative, John Adler; New York City Finance Commissioner Jacques Jiha; New York City Police Commissioner James P. O’Neill (Chair); Patrick Lynch, Patrolmen’s Benevolent Association; Michael Palladino, Detectives Endowment Association; Edward D. Mullins, Sergeants Benevolent Association; Louis Turco, Lieutenants Benevolent Association; and, Roy T. Richter, Captains Endowment Association.

New York City Fire Pension Fund: Mayor Bill de Blasio’s Representative, John Adler; New York City Fire Commissioner Daniel A. Nigro (Chair); New York City Finance Commissioner Jacques Jiha; James Slevin, President, Gerard Fitzgerald, Vice President, Edward Brown, Treasurer, and John Kelly, Brooklyn Representative and Chair, Uniformed Firefighters Association of Greater New York; John Farina, Captains’ Rep.; Paul Mannix, Chiefs’ Rep., and Jack Kielty, Lieutenants’ Rep., Uniformed Fire Officers Association; and, Thomas Phelan, Marine Engineers Association.

Board of Education Retirement System: Schools Chancellor Carmen Fariña; Mayoral: Issac Carmignani, T. Elzora Cleveland, Vanessa Leung, Gary Linnen, Lori Podvesker, Stephanie Soto, Benjamin Shuldiner, Miguelina Zorilla-Aristy; Michael Kraft (Manhattan BP), Debra Dillingham (Queens BP), Geneal Chacon (Bronx BP), April Chapman (Brooklyn BP), and Peter Calandrella (Staten Island BP); and employee members John Maderich of the IUOE Local 891 and Donald Nesbit of District Council 37, Local 372.

###