SCHUMER: ALBANY’S LANDMARK “NIPPER” BUILDING SHOULD BE ADDED TO THE NATIONAL & STATE REGISTERS OF HISTORIC PLACES; SENATOR URGES NATIONAL PARK SERVICE & NYS HISTORIC PRESERVATION TO EXPEDITE APPROVAL PROCESS SO THAT VITAL FEDERAL HISTORIC TAX CREDITS CAN BE USED TO TRANSFORM THE BUILDING AND PRESERVE THE BELOVED STATUE FOR FUTURE GENERATIONS

The Old RCA Victor Dog Nipper Is Still Sitting On The Roof of The Former RCA Building In Albany; Senator Says The Statue Has Become a Regional Icon, And Represents A Part Of Albany History: New Development Plan Would Transform Nipper Building Into a Vibrant Downtown Residential and Commercial Space

Schumer To Feds: Expedite Application To Unlock Tax Credits Before Nipper Is "Ruffed" Up

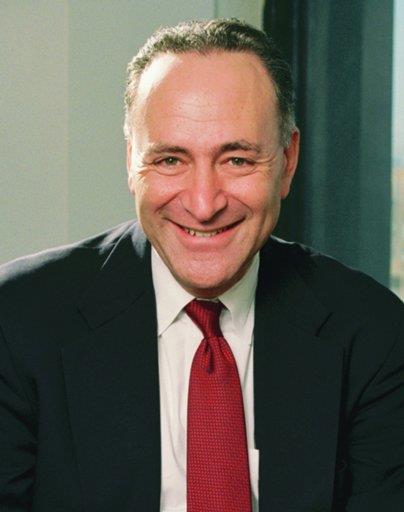

U.S. Senator Charles E. Schumer recently visited Albany and urged the National Park Service (NPS) and the State Historic Preservation Office to immediately add the “Nipper” building and statue, one of Albany’s iconic properties and beloved landmarks to the National Register of Historic Places. Schumer said this historic designation is the key to unlocking vital federal Historic Tax Credits for an ambitious adaptive reuse of the “Nipper Building” at 991 Broadway. Schumer explained that this designation and tax credits would not only help transform this over 100-year-old structure into a residential and commercial gem, but it would also help protect and maintain Nipper, the 28 foot tall fiberglass white terrier that has been on top of the building since the 1950s.

“Nipper may be made of fiberglass but his watching over the City of Albany for the last 60 years has certainly woven him into the very fiber of this community. Adding Nipper to the National Register of Historic Places would be a tremendous step forward in appropriately honoring the role that Nipper and this historic building have played in Albany over its history. More importantly, having this designation would also help the future building owner and developer defray 20% of the costs of exterior restoration and interior rehabilitation,” saidSenator Schumer. “This designation would be a win-win for the city. That’s why I am urging the feds to quickly approve this application to add this terrific old building beloved statue to the register, to help Nipper be preserved for future generations to come.”

Schumer is urging the NPS and SHPO to list the Nipper Building on the National Register of Historic Places, citing that it would not only help Nipper remain on top of the building for future generations to enjoy, but, more importantly, enable Nipple Building, LLC to tap into the federal historic tax credits as it undertakes this important adaptive reuse transformation of 991 Broadway. Schumer said this project is widely supported by the community because it would preserve significant and distinctive history, while complementing the surrounding neighborhoods. Without these tax credits, the adaptive reuse costs could be prohibitive. Schumer therefore urged NPS to expedite the developer’s application to list the “Nipper Building” on the National Register of Historic Places so that the beloved statue can be preserved for future generations.

Schumer explained that the “Nipper Building” in Albany was originally built in 1906. Formerly an American Meter Company building from 1906 until the 1950s, the building gained further recognition from 1957-58, when the new owners, Radio Corporation of America (RCA), constructed Nipper. The statue of the dog has been on top of the building for almost 60 years and is visible from 5 miles away, making him an integral part of Albany’s revitalized warehouse district. Arnoff Moving & Storage has occupied the building since RCA and Schumer said the family has done an incredible job with preserving Nipper, which has become a staple of the community over the decades.

Schumer explained that the Arnoff family is now selling the Nipper Building, located at 991 Broadway, and its three adjacent properties to a developer that plans to convert the buildings into a mix of $70 million worth of residential and commercial space. Specifically, the developer, Nipper Apartments, LLC, intends to develop the structure into more than 150 apartments, with additional space for parking and retail shops. The creation of new apartment unities and room for businesses, restaurants and shops in the neighborhood has many locals excited about the prospect of greater development in the warehouse district.

Inclusion on the National Register of Historic Places is an important first step that enables a property owner to receive Federal Historic Tax Credits which provides a 20% tax credit for rehabilitation of historic structures for income-producing properties listed on the register. The historic tax credit applies specifically to income-producing historic properties, and throughout its history it has leveraged many times its cost in private expenditures on historic preservation. This program is the largest Federal program specifically supporting historic preservation, generating over $78 billion in historic preservation activity since 1976. During Fiscal Year (FY) 2015, the National Park Service approved 1,283 proposed projects representing an estimated $6.63 billion of investment to restore and rehabilitate historic buildings.

From FFY13-15, the tax credit program resulted in over $3 billion of investment in NYS. Although dollar amounts vary from year to year, the numbers of projects is on the increase, due primarily to upstate projects taking advantage of the program in tandem with the state rehabilitation tax credit. NYS Leads the Nation with Listings on the National Register with having recently surpassed 6,000 nominations that include 120,000 properties. The federal and New York state historic preservation tax incentives programs have generated billions of dollars in private investment for the rehabilitation and adaptive reuse of historic buildings. The program has become one of New York State’s go-to resources for developers and has made historic preservation one of the state’s key economic development tools.

A copy of Schumer’s letter to NPS appears below:

Dear Ms. Pierpoint,

I am pleased to write today in support of placing the “Nipper Building” also known as the American Meter Company Building, located in Albany, New York on the National Register of Historic Places through the National Park Service (NPS). This important designation would not only help to protect the historical integrity of this over 100-year-old structure and maintain Nipper, the more than 25 foot tall fiberglass white terrier that has been on top of the building since the 1950s, but most importantly allow for the use of historic tax credits in a vital adaptive reuse of the building.

As you may know, the “Nipper Building” in Albany, New York was originally built in 1906. This four story flat roof structure, was constructed with reinforced concrete, which was the 20th century method that replaced the older heavy timber framing construction method that most 19th century factories were made with. Formerly an American Meter Company building from 1906 until the 1950s, the building gained further recognition when in 1957-58 the new owners, Radio Corporation of America (RCA), constructed Nipper, a 28 foot tall fiberglass white terrier that has been on top of the building for almost 60 years. Nipper, who is based upon an actual mixed stray terrier that died in 1895, is visible from 5 miles away, making him an integral part of Albany’s revitalized warehouse district. Listing the Nipper Building on the National Register of Historic Places would allow for Nipper to not only remain on top of the building for future generations to enjoy, but it would also be a great step forward in appropriately honoring the role that Nipper and this historic building have played in Albany over its history.

Furthermore, adding the Nipper Building to National Register of Historic Places would help defray the costs associated with a comprehensive exterior restoration and interior rehabilitation of the historic structures. The developer, Nipper Apartments, LLC, intends to develop the structure into more than 150 apartments, with additional space for parking and retail shops. State and Federal tax credits would help to defray the costs associated with a comprehensive exterior restoration and interior rehabilitation of the original 1906 building. Listing the historic hospital on the National Register of Historic Places would allow the LLC to apply for historic tax credits, facilitating an adaptive reuse project that is widely supported by the community because it would preserve significant and distinctive history, while complementing the surrounding neighborhoods. Without these tax credits, adaptive reuse would be cost prohibitive.

Again, I urge you to place the “Nipper Building” on the National Register of Historic Places in order to maintain the historical integrity of this over 100 year old structure, while also ensuring that Nipper the dog remains an important part of the community for generations to come. I look forward to working with you on this important issue.

Sincerely,

Charles E. Schumer

United States Senator