Senator Warren Launches Investigation of Rewards and Incentives Offered to Annuities Dealers Advising Retirees

Senator asks companies about perks including luxury cruises, five-star resort vacations, iPads, and diamond-encrusted "NFL Super Bowl Style" rings

Questionable practices highlight the need for a strong conflict-of-interest rule for retirement advisors

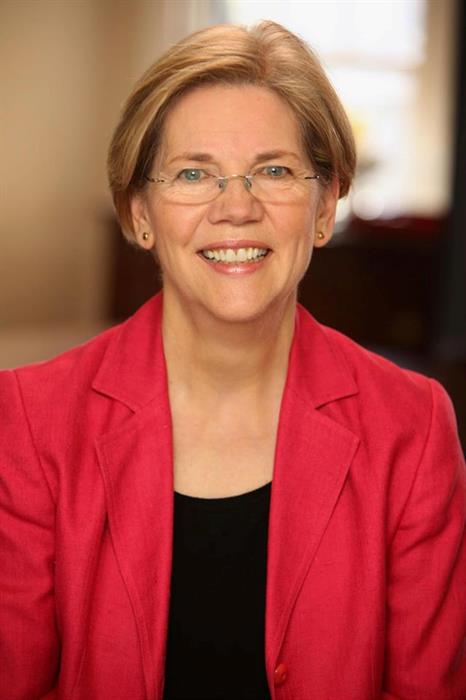

In letters sent to 15 of the country's largest annuity providers today, United States Senator Elizabeth Warren raised concerns about the rewards and incentives these companies offer to brokers and dealers who sell annuities to families and small investors. The letter explains that "annuity providers offer a vast range of perks - from cruises to international travel to iPads to diamond-encrusted ‘NFL Super Bowl Style' rings to cash and stock options - to entice sales of their products."

"I am concerned that these incentives present a conflict of interest for agents and financial advisers that could result in these agents providing inadequate advice about annuities to investors and selling products that may not meet the retirement investment needs of their buyers," Senator Warren wrote. The Senator notes particular concern about the impact on individuals who are on the verge of retirement because they have little time or ability to recover potential losses from bad investments.

The questionable practices identified in today's letters highlight the need for a strong conflict-of-interest rule from the U.S. Department of Labor (DOL) to protect retirees by requiring advisors to act in their clients' best interests. DOL released a proposed rule earlier this month. "Annuity agents that are more interested in earning perks than in acting in their clients' best interest can place Americans' savings and retirement security at risk," the Senator wrote.

Senator Warren today asked annuity providers for information about the incentives they offer, the number and value of the incentives awarded, and the companies' policies for disclosing these potential conflicts of interest. The letters were sent to the 15 companies with the highest 2014 U.S. individual annuity sales: Jackson National Life, AIG Companies, Lincoln Financial Group, Allianz Life, TIAA-CREF, New York Life, Prudential Annuities, Transamerica, AXA USA, MetLife, Nationwide, Pacific Life, Forethought Annuity, RiverSource Life Insurance, and Security Benefit Life.

A PDF copy of the letters is available here. Examples of the kinds of incentives companies offer to annuities brokers and dealers is available here.