SCHUMER LAUNCHES PUSH TO ENABLE FAMILIES TO USE FED “529 COLLEGE SAVINGS FUNDS” TO PURCHASE COMPUTERS TAX FREE – CURRENTLY HUNDREDS OF THOUSANDS OF NEW YORKERS WITH “529” PLANS CAN ONLY RECEIVE TAX BENEFIT WHEN PURCHASING SUPPLIES LIKE TEXTBOOKS, BUT NOT COMPUTERS

529 Accounts Are A Critical Tool Many Families Use To Save For College; As Long As Money Is Being Put Toward College or College-Related Expenses, It Can Be Withdrawn Tax Free – However, Computers Do Not Qualify For This Benefit & Families Are Hit With Significant Tax When Withdrawing Funds To Purchase a New Laptop or Desktop

Schumer Pushes New Legislation To Make Computers Eligible For Tax Advantage; Computers Are A Critical Part of College Education & Should Get Same Treatment as Textbooks – Bi-Partisan Bill Also Eliminates Unnecessary “529” Paperwork & Gets Rid of Steep Penalties Currently In Place For Students Who Have To Withdraw from School

Schumer: Computers Should Get Same Treatment Under “529” Plan As Textbooks

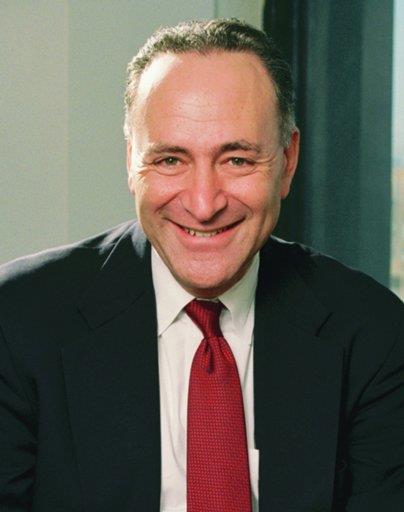

U.S. Senator Charles E. Schumer recently launched a push to enable families to make tax-free withdrawals from their “529 College Savings Plans” to purchase computers. Currently, families can only withdraw funds from “529” accounts tax-free in order to pay for college costs and a select number of college-related expenses like textbooks, but they cannot get that same tax advantage if using the funds to purchase a computer. Schumer said having a computer is a necessity for today’s college student, and therefore should be a qualifying expense for the over 800,000 “529” accounts in New York. Schumer announced he is pushing a bi-partisan bill that would open up “529” accounts to purchasing computers without a federal tax hit; the legislation also eliminates unnecessary paperwork for “529” account holders and gets rid of steep financial penalties for students that put school on hold. Schumer said that all-in costs for computers, software and related technology can be $2,000 or more – a major expense for a middle-class family – and if this bill becomes law, families could save hundreds of dollars off of their tax bill for this major purchase.

“The 529 plan is one of the most successful ways middle-class families have to save for college tuition, but it has been years since the rules of the savings plan have been updated. While you can now deduct money tax free from your 529 account to pay for education-related expenses like tuition, books, or room and board – you can’t deduct money to buy perhaps the largest education-related expense outside of those items: a computer. And that makes no sense,” said Schumer. “If families can’t use their savings on the most common, and typically one of the most expensive, items related to a college education – that totally diminishes the purpose of the savings plan. No one needs tax incentives to buy an abacus any longer. We need to make sure the 529 savings plan is keeping up with the times.”

Schumer explained that “529 College Savings Plans” are a tax-advantaged way for families to save for the future higher education expenses of their children, grandchildren, and immediate family members qualifying as a beneficiary. These expenses can include tuition, room and board, and other college-related expenses. According to the College Savings Plans Network, the “529” savings plan allows account holders to invest that money to build up their “cash” balances. This money, managed by a state fund— is typically invested in mutual funds and other low-risk accounts—accrues tax-free and can be withdrawn tax-free for any qualified higher education expenses, including tuition, room and board, textbooks, and other college-related supplies.

Schumer said “529” accounts are a critical tool that many middle-class families use to save for college, and that the money being put towards college or college-related expenses can be withdrawn tax-free. However, while families can withdraw funds from “529” accounts tax-free in order to pay for college tuition and a select number of college-related expenses like textbooks, they cannot get that same tax advantage if using the funds to purchase a computer. Schumer explained that, because a computer is not considered a “qualified” expense under current law, if a family took out money from their “529” account to pay for one, that withdrawal would be subject to income tax and an additional 10 percent penalty tax. Schumer said that while the “529” accounts have been a major benefit to families, the rules need to be updated, as having a computer while attending college is a necessity. That is why Schumer is announcing bi-partisan legislation that would not only open up these “529” accounts to purchasing computers without a federal tax hit, but also eliminate the unnecessary paperwork that “529” account holders face and get rid of steep financial penalties for students that put school on hold.

Schumer said that a computer should be a qualifying expense for the over 800,000 “529” accounts in New York State. Schumer said that if families cannot use their savings on a computer, which is typically one of the most expensive items related to a college education, this would diminish the purpose of having a savings plan in the future. Schumer also said that many families open “529” accounts rightfully expecting computers to be a qualifying expense, and the rules should be updated to match the reality, which is that often a new computer is part of the expense of going to college. For example, if a family of four that makes $80,000 a year and falls within the 15% tax bracket after deductions, purchases a Dell laptop, anti-virus software, computer charger, Microsoft Office and a backup hard drive for $1,200 for their child going off to college, that family would face a $300 federal tax hit—their 15% federal tax rate, plus the 10% penalty—under current law if they were to take that money from their “529” account to spend on these purchases. Under Schumer’s new legislation, this tax hit would be eliminated, saving the family $300.

Schumer is pushing this legislation with a bipartisan group of Senators, including Sen Kelly Ayotte [R-NH], Sen Richard Burr [R-NC], Sen Benjamin L. Cardin [D-MD], Sen Robert P. Casey, Jr. [D-PA], Sen Susan M. Collins [R-ME], Sen Johnny Isakson [R-GA], Sen Mitch McConnell [R-KY], Sen Pat Roberts [R-KS], Sen Charles E. Schumer [D-NY], Sen Tim Scott [R-SC], and Sen Mark R. Warner [D-VA].

The bill has three major provisions. First, it would address the inability to use funds saved by families for laptop or desktop computers and computer-related equipment and software. Schumer said that, in today’s world, a computer is just as much a necessary educational expense as a required class textbook. As a result, this bill would allow “529” account holders to purchase a computer and computer software on the same tax-favorable basis as other required materials. Second, this bill would eliminate outdated and unnecessary paperwork for “529” account holders. Finally, the bill provides a fix that would allow students who have to withdraw from school as a result of illness or other reasons a refund from the college for the semester. Under current law, any refunds from the college are subject to immediate taxation and a 10 percent tax penalty. Schumer said this legislation would allow the refunded tuition to be re-deposited back into a “529” account without facing a tax penalty. Schumer said this would allow a family to set the refund aside to pay for the student’s education when he or she is able to return to college or to use it for another family member attending college. Schumer said getting rid of steep financial penalties for refunds and streamlining paperwork associated with these plans will place fewer costs on plan administrators and result in fewer students putting school on hold due to hang-ups.

According to a March 2015 report from the College Savings Plans Network, as of December 2014, the average balance in a “529” account was $20,474 nationally, compared to $10,690 at the end of 2008. The number of accounts across the country has grown to 12 million in 2014, up from 1 million in 2001. New York State’s 529 Direct Plan and Advisor Plan currently hold a combined $20.8 billion in assets from around 811,000 accounts, up from 510,000 accounts in 2009, with an average account balance of $25,600 for the Direct Plan and $20,800 for the Advisor Plan. As reported in the Fiscal Times, Strategic Insight, a mutual fund research firm, found in a 2014 survey that 70 percent of “529” account holders have incomes under $150,000. Because the majority of these accounts are held by middle-class families, Schumer said, improving these accounts is one of the most important things Congress can do to maintain college affordability for middle class families.

Schumer has long fought to pass education tax benefits and make college more affordable for middle class families struggling to keep up with the rising costs of tuition and supplies. Earlier this year, Schumer announced that he would introduce new legislation to increase and expand eligibility for a tax credit that provides critical relief for middle class families by enabling them to offset the cost of college tuition. Schumer’s legislation, the American Opportunity Tax Credit Permanence and Consolidation Act (AOTC), would allow families to take one dollar off their taxes for every dollar spent on tuition, would grow the savings a family can receive per student to $3,000 per year, make the credit available to families earning up to $200,000 per year, and increase eligibility by changing the lifetime limit of the credit from a number of years claimed—four years under current law—to a maximum monetary amount of $15,000. The credit, which Schumer helped pass into law in 2009, is currently available to families earning less than $180,000 per year and only provides a tax credit of up to $2,500. Schumer said that boosting this tax credit would help provide a needed benefit to families across Upstate New York who are dealing with the rising cost of college tuition. This tax credit already helps New York families save over $1 billion per year, and Schumer said his new legislation would enable families to save even more.

During the call, Schumer presented a breakdown by county of the approximate number of “529” accounts in New York State. Across Upstate New York in particular, there are an estimated 344,762 of these “529” accounts:

· In the Capital Region, there are an estimated 47,464 “529” college savings plans.

· In Central New York, there are an estimated 43,182 “529” college savings plans.

· In Western New York, there are an estimated 55,297 “529” college savings plans.

· In the Rochester-Finger Lakes, there are an estimated 50,106 “529” college savings plans.

· In the Southern Tier, there are an estimated 31,332 “529” college savings plans.

· In the Hudson Valley, there are an estimated 95,290 “529” college savings plans.

· In the North Country, there are an estimated 22,091 “529” college savings plans.

A 529 Plan is a tax-advantaged investment plan designed to encourage saving for the future higher education expenses of a designated beneficiary. The plans are named after Section 529 of the Internal Revenue Code and are administered by state agencies and their private sector partners. 529 plans were designed as a way to encourage people to save for college for their children, grandchildren, or any other beneficiary. According to the College Savings Plans Network, statistics students with any amount saved for higher education are six to seven times more likely to attend a four-year institution than those without any savings, making the 529 savings plan a key incentive for helping families send their children to college.

###