SCHUMER JOINS WITH PARENTS OF COLONIE NATIVE & SUNY COBLESKILL GRAD LAUREN TANSKI, WHO WAS TRAGICALLY KILLED TWO YEARS AGO, AND PUSHES PLAN THAT WOULD REQUIRE PRIVATE LOAN COMPANIES TO IMMEDIATELY FORGIVE DEBT AFTER DEATH OF STUDENT BORROWERS – PARENTS SHOULD NOT BE FORCED TO CONTINUE PAYING STUDENT LOANS AFTER TRAGIC DEATH OF A CHILD

In 2013, Colonie Native Lauren Tanski Was Tragically Killed By Her Roommate’s Ex-Boyfriend, While Living in New Orleans – When Lauren Died, She Had $30K in Outstanding Fed Student Loan Debt & $60K in Private Student Loan Debt; Fed Loans Were Immediately Forgiven, but Private Loans Were Not; Schumer Worked With Family To Get Private Loans Forgiven, But Law To Protect Grieving Families is Needed

Schumer Announces Major Effort This Congress To Pass Legislation That Would Require Private Student Loans to Be Discharged if Borrower Dies, Ensuring Parents Aren’t Held Liable for Debt – New Requirement Needed to Prevent Some Private Loan Providers From Hounding Grief-Stricken Parents

Schumer: No Parent Should Be Put Through The Ringer By Student Loan Companies Following the Death of A Child

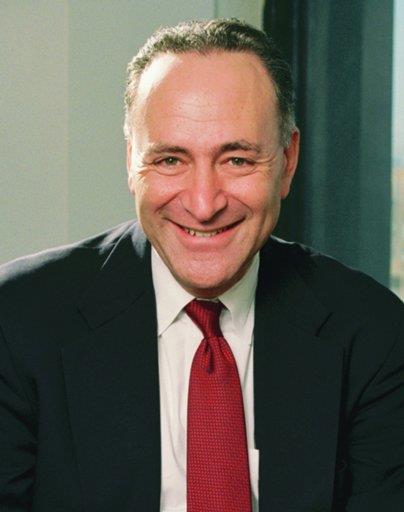

At the Federal Building in Albany, U.S. Senator Charles E. Schumer recently joined with the parents of Lauren Tanski, a Colonie native who was tragically killed two years ago by her roommate’s ex-boyfriend, to launch a major push to pass legislation that would require private student loan companies to forgive outstanding debt if a student borrower dies. At the time Lauren was killed, she had $90,000 in student loan debt – $30,000 in federal loans, which by law were immediately forgiven, and $60,000 in private student loans, which were not. Schumer worked with the Tanski family to get the private loan debt forgiven, but Schumer said that the Tanski family’s experience proves a strong federal law is needed to prevent private companies from forcing grieving families to pay back the loan. Schumer's legislation would help ensure that the unnecessary financial and emotional strain experienced by the Tanski family – who had to fight with Sallie Mae, the loan company, in the wake of their daughter’s death – is not repeated. Schumer's legislation would require that private student loans be discharged if the borrower dies, ensuring that parents who had cosigned the loan are no longer held liable for the debt. Currently, all federal student loans are required to be fully discharged if a family member or other representative provides a certified copy of the death certificate to the lender or loan servicer. Schumer's legislation would apply the same treatment for all prospective private student loans.

“This legislation will help ensure that student loan debt is one burden that grieving parents—like Andrew Prior’s and Lauren Tanski’s—do not have to bear. This law may be called ‘Andrew’s Law,’ but it could also be called ‘Lauren’s Law.’ And I am sure it could be named after dozens of other individuals throughout the country whose parents have had to battle student loan companies for debt forgiveness in the wake of the tragic loss of their child. The fact that this happens time and time again shows that federal legislation is needed; we should not be fighting these battles on a case-by-case basis,” said Senator Schumer. “No parent should ever be put through the ringer by callous servicers and lenders, and there is no question that we need to put this common sense and compassionate policy into law. Sadly, we can’t always rely on these private companies to do the right thing for suffering parents; and we need to write the rules – which would require that private student loans are discharged if a borrower dies – in stone.”

Schumer said that while federal student loans are required by law to be discharged in the event that the borrower dies, the same requirement does not apply to private student loans. Schumer has led the charge to hold private loans to the same standard as federal loans, and announced today a major effort to pass legislation this Congress that would help ensure that the unnecessary financial and emotional strain experienced by families like the Tanskis – who are often forced to confront aggressive debt collection agencies in the wake of tragedy – is not repeated.

Schumer’s legislation would require that private student loans be discharged if the borrower dies, ensuring that parents who had co-signed the loan are no longer held liable for the debt. Schumer’s legislation would apply the same treatment for all prospective private student loans. Schumer highlighted that many private loan providers are upstanding corporate citizens and have established programs to forgive debt in the event of the student borrower’s death, just as federal loans do. While this precedent allows for compassion to enter the financial marketplace, Schumer said that this practice must be universal, and there should be no room for bad actors to hound grief-stricken parents for their life-savings. Schumer said that while having a policy like this at individual companies is a good start, more needs to be done on the federal level to ensure grieving families will never have to fight with less-forgiving student loan companies in the event of a child’s death.

Schumer explained that the death of a student borrower is rare when compared to the population of American student borrowers. Forgiveness of these loans under such a unique yet tragic circumstance as death would have an insignificant impact on the larger private loan system and ratepayers, while offering incredible financial and emotional relief to these families. Private student loans made up less than 20 percent of total student debt outstanding as of 2012 and less than 6 percent of all undergraduates—approximately 1.4 million—borrowed private loans from 2011-2012. Most private loans require at least one borrower to be “creditworthy,” meaning they must be currently employed, have a minimum credit score and, in more recent years, meet other criteria such as a debt to income ratio. Many undergraduate students would not meet these requirements, and therefore, today, most private loans for undergrads—which constitutes a large portion of loans to students overall—must be cosigned by a creditworthy person. This person is oftentimes a parent. However, Schumer said, grieving parents should not have to worry about paying off this debt after the tragic loss of a child.

Schumer has long fought to make this legislation—called “Andrew’s Law,” named after a Central New Yorker who was tragically killed a few years prior to Lauren—a reality for families so they do not need to battle with student loan servicers after the loss of a child. Schumer announced today that he is making a major push during this Congress to pass this legislation. Schumer first introduced this legislation in 2013, following the tragic death of Syracuse-native Andrew Prior, for whom the legislation is named. Schumer said “Andrew’s Law” was created to honor Andrew Prior, but could also be named after dozens of other individuals throughout the country whose families have experienced this great loss and immense financial burden following the death of a child.

Andrew Prior, for whom the initial legislation was named, was tragically killed by a drunk driver shortly after graduating from college. Andrew Prior had one federal loan and three outstanding private student loans at the time of his death, which were cosigned by Andrew’s parents, Mr. and Mrs. Prior. The federal loan and two of the private loans were forgiven shortly after Andrew’s passing, yet it took over two years, and Schumer’s aggressive intervention, for the loan servicer to forgive the remaining student loan debt.

Lauren Tanski was a 27-year-old Colonie native who had lived in the Capital Region for nearly her entire life. She moved to New Orleans in November of 2012 and was tragically lost just a few months later. In January 2013, Lauren was found dead in her apartment after being brutally murdered by her roommate’s ex-boyfriend. At the time Lauren was killed, she had $90,000 in student loan debt – $30,000 in federal loans and $60,000 in private student loans, some of which were scheduled to be paid back despite her death. While the federal loan debt was immediately forgiven, Schumer had to fight alongside the Tanski family to get the private loan debt forgiven. Schumer said that the Tanski family’s experience proves a strong federal law is needed to prevent private companies from forcing grieving families to pay back the loan.

Schumer was joined by Leonard and Linda Tanski, the parents of Lauren Tanski.